The Price of an Education–What You’ll Pay Today

Today we paid the remaining balance of what is due for my son’s first semester of college.

We had no choice. We had two days left to pay it in full or he was automatically “un-enrolled”. Is that even a word? At the price we’re paying for this education, I hope he finds out by the end of the semester.

Did I mention that this one semester alone is already twice as much as my entire education cost at UF when I attended 20 years ago?

Since the point of my blog is to help others learn from my mistakes, I’m going to lay it all out here for you. And trust me when I say I didn’t think I was making any mistakes with this. I planned so long ago for these expenses, hoping and praying he’d make it to college and knowing I didn’t want to stress over what it would cost when he got there.

Heck, I prepaid his tuition way back when he was two years old.

Yes, you read that right.

In Florida, back in 1996, I went ahead and signed up for a prepaid tuition plan for my son. Doing this locked in the tuition at 1996 rates. So, when he started college in 2012, the idea was that he’d be paying the 1996 rates. Sweet deal, huh?

I paid about $7300 for that plan. It wasn’t easy, but I knew I could come up with the money to do it then and wasn’t sure what the future would look like 16 years later when it came time to actually attend.

Through those years, I always considered this the smartest thing I ever did for my child.

And it was…right up until I found out my precious alma mater, UF, didn’t offer his major. And even if it did, my a-little-above-mediocre student would have to be accepted at this school that had somehow become home to much more than mediocre.

Living in Georgia, we would have paid in-state rates for any school here. Having prepaid for Florida, he could have gone to any school in that state and would have been considered an in-state student.

What he couldn’t do was go to a university in Alabama, say The University of Alabama, and expect in-state rates. There are exceptions, but his test scores were one point too low to make him eligible.

That one point ended up being worth about 16 thousand dollars.

Right. 16 thousand.

Dollars. Each year.

That one point will mean more than 60-THOUSAND DOLLARS by the time it’s all over.

And wouldn’t you know it? That’s the school my son decided was the right one for him.

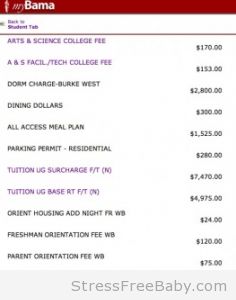

Sure, we could transfer the money that would have gone to UF and use it in Alabama. With a catch. We wouldn’t get the money at UF rates. The state takes an average of tuition at all state schools, from community college on up, and uses that as the rate that gets sent out of state. So, we ended up with a whopping $1732 this semester. Doesn’t seem fair, does it?

And it’s not, but it’s the gamble I took way back when. And it’s something.

Meantime, it’s up to us to come up with the rest of what it will take to pay for this education.

That means about $10,000 in loans for my son. And about $18,000 out of pocket for me. Each year. Every year. For four years. We hope it’ll just be four years.

Ouch.

I’m fortunate to be able to come up with the money to help, at least this semester, and he understands he’ll be getting out of college with a burden that may equal his annual salary, should he be able to get a job in this profession he adores.

But what about the kids whose parents can’t do it? That would have been me 20 years ago. My parents didn’t have the money to do much more than drive me to the dorm and drop me off. I got through college in three years because of it. I knew it was on me to cover my costs, so I took as many classes as I could each semester, trying to save money I’d have to pay for rent if I stayed longer. And it worked. I busted my ass to do it, but I did it. I partied, too, but I always knew it was on me to excel in classes because I didn’t have the luxury of failing.

I hope my son understands that as he starts his college career.

At this point, we’ve only paid for one semester. We have about four months to come up with the next fourteen grand.

$14 grand.

That’s a lot of money folks.

And they’re talking about raising rates even more. Who knows what it’ll be by the time my seven year old hits campus?!

Maybe by then I’ll hit the lottery.

I can dream.

It’s scary stuff, huh? So, without sending you into a panic, tell me what your plan is.

What are you doing to save for your kids’ college education?

Let’s hope it’s enough.

August 8, 2012 @ 5:41 pm

So much for stress-free, eh? No way I’m having kids 🙂

August 8, 2012 @ 7:46 pm

Aw, Will, come on now…they’re really expensive but take you on some priceless adventures. You’d make a fun dad some day! Hope you’ve been doing great and seeing neat places!

August 9, 2012 @ 12:19 am

Well, your site *is* called “Stress-Free BABY”–not “Stress-Free Young Adult”! LOL

Like you, I had to work my way through college and I’m sad to say, my kids are going to have to do the same. We are still paying off my husband’s student loans, which stinks…but since I met him at college, I guess that’s OK! 🙂

August 9, 2012 @ 8:35 am

College tuition is crazy! Funny that we think we are doing our best to plan ahead and then life takes different turns. Celebrate that your son found the school right for him, and everything else hopefully will fall into place. 🙂

Weekly Roundup: Landlords, Diapers and Country Girls | Budgets Are Sexy

August 24, 2012 @ 5:02 am

[…] The Price of an Education – What You’ll Pay Today @ Stress-Free Baby […]